Redefining Lending in the Digital Age

Credit managers and risk heads at banks and NBFCs are consistently confronted with the task of identifying and assessing creditworthy businesses. As non-performing assets (NPAs) pose increasing risks, it becomes imperative for technology to play a pivotal role in the digital transformation of lending. By establishing standardized business rules and generating auditable and traceable digital records, technology becomes the linchpin of this transformation journey.

01

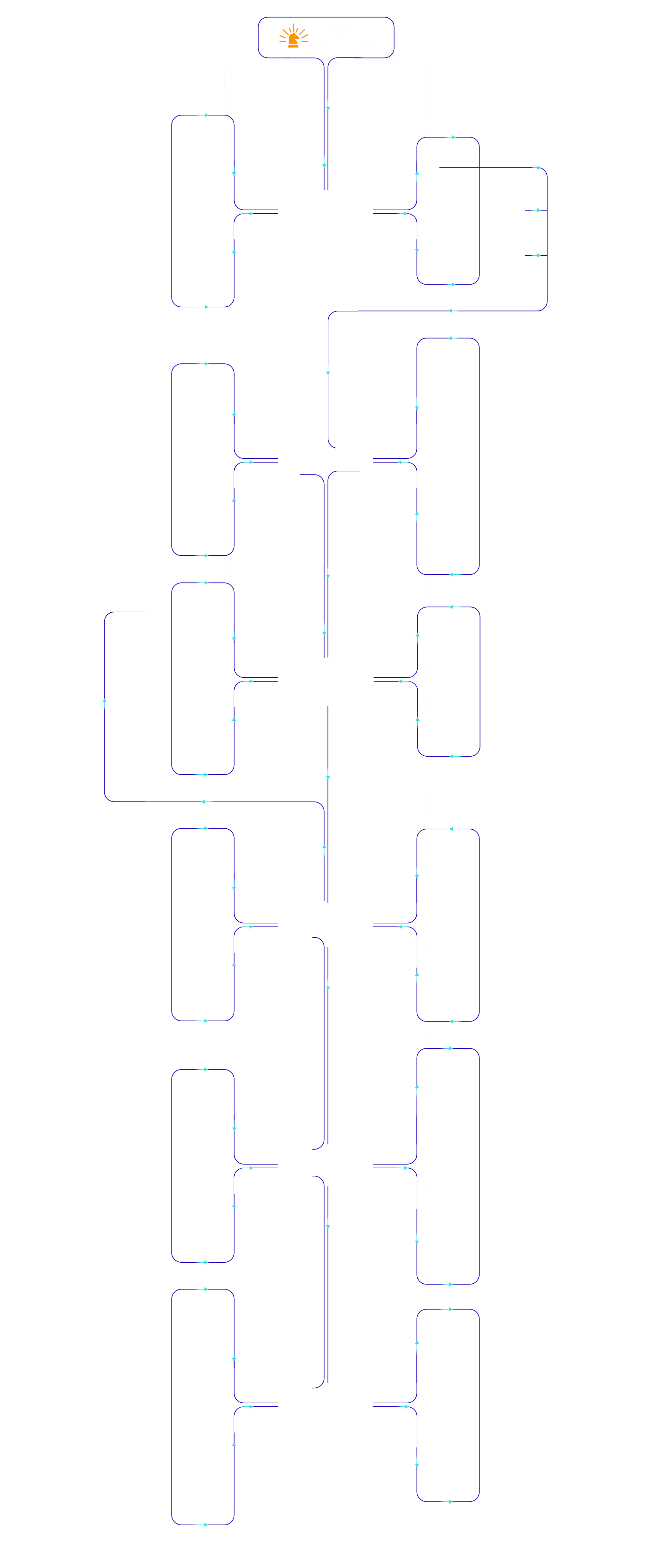

Sourcing

Source loans intelligently, optimizing risk and return, identify, evaluate, and secure loans efficiently.

02

Processing

Elevate loan processing efficiency with intelligent origination, seamless BRE/CAM integration, and rapid sanction and disbursal.

03

Management

Streamline accounting, generate SOAs, manage product masters, track DPDs and monitor NPAs efficiently, ensuring a seamless loan management

04

Collection

Transform loan collection with our virtual account management, secure escrow accounts, and optimised debt recovery processes.

Revealing Our Success in Figures

0

End user impacted

0

YoY Growth

0

AUM

0

Clients

0

Implementation Success Rate

Signature Value Proposition

Optimize your lending strategy with our advanced platform, equipping you with streamlined processes, comprehensive risk management, and unprecedented growth possibilities.

digital lending solution

Maximize productivity and streamline your lending operations with our holistic suite of solutions, spanning the entire lending lifecycle and ensuring end-to-end efficiency.

digital lending solution

Maximize productivity and streamline your lending operations with our holistic suite of solutions, spanning the entire lending lifecycle and ensuring end-to-end efficiency.

Create fully customizable workflows, on-screen questions, and dropdowns tailored to your specific loan products without the need for any code changes.

Access all application-related data in a read-only format through our user-friendly interface, featuring standardized credit policies for swift decision-making, facilitating a streamlined Go/No-Go assessment process.

Experience a seamless workflow that enables the capture of customer consent (OTP) for GST, ITR, or Aadhar verification. An email containing a link to the page in the assisted journey is sent to the customer, ensuring a smooth and secure process.

Experience a seamless workflow that effortlessly captures all the required information and documents, including financials, bank statements, KYC, and other essential loan-related documents.

Define customized journeys for LOS or Bank Statement, Financial Statement, Credit Bureau, and GST-only processes, whether it's an assisted journey or self-service journey, tailored to your specific needs.

Navigate lending effortlessly with personalized loan recommendations, real-time support, and interactive tools for a streamlined borrowing experience on our website.

Elevate your lending experience on our website with dynamic, AI-driven support, ensuring swift approvals and tailored financial solutions through cutting-edge algorithms.

Streamline the lending process on our website with seamless electronic Know Your Customer verification, ensuring secure and efficient customer onboarding.

Enhance lending security on our website through comprehensive customer Know Your Customer checks, ensuring compliance and safeguarding financial transactions.

Experience a seamless workflow for RBI-compliant Video KYC, eliminating the need for in-person verification (IPV) and ensuring hassle-free customer onboarding.

Transform your lending journey with our website's cutting-edge feature, ensuring authenticity through a seamless process of Original document verification, User interaction confirmation, and Verification checks for a secure borrowing experience

Streamline the process with paperless digital verification of Ultimate Beneficial Owners (UBO), conduct AML checks on individuals and promoters, and gain comprehensive control with cKYC read/write access.

Effortlessly handle FATCA compliance through a paperless process, perform AML checks on individuals and promoters, and enjoy full control with cKYC read/write access.

Ensure seamless Bank Account Verification for both individuals and companies with our penny drop method, eliminating the need for crossed cheques.

Effortlessly verify PAN cards for companies, directors/UBOs, and individuals directly through NSDL, simplifying the document verification process.

Enhance your AML (Anti Money Laundering) measures with paperless UBO and FATCA compliance, digital UBO verification, and robust AML checks on individuals and promoters, all while maintaining comprehensive control with cKYC read/write access.

With a simple drag-and-drop feature, an interactive BRE can be constructed, seamlessly linked to any rule encompassing 5000+ data points, and easily connected to various loan products. The platform also allows for the definition of multiple output CAM and scoring engines.

Leverage our platforms flexibility to define multiple output CAM and scoring engines for enhanced customization.

Leverage versatile workflows to oversee multi-level approval processes, covering creator (L0), credit vetting (L1), legal vetting (L2), and final checker (L3) stages efficiently.

Utilize flexible workflows to manage multi-level approval processes, encompassing various stages such as creator (L0), credit vetting (L1), legal vetting (L2), and final checker (L3).

Easily monitor the progress of your applications at every stage, from documentation and credit/vetting to deduplication, BRE, final approval, sanction, and disbursement, with intuitive visual tracking.

Expedite lending decisions on our website through real-time automated approvals, leveraging advanced algorithms and data analytics for swift and reliable loan sanctions.

Automate loan disbursements, facilitating direct transfers to the borrower's account or escrow account, and benefit from the system's automatic creation of loan accounts for easy management.

Optimize your lending experience on our website with sophisticated financial scrutiny, utilizing advanced algorithms to analyze bank statements for accurate risk assessment and personalized loan offerings.

Leverage robust data visualizations to effectively analyze GST payments and input credits. Perform detailed analysis of multiple GST data sets, while also having the ability to generate aggregated or consolidated analyses at the firm-wide level. The platform also provides revenue and expense analysis functionalities.

Fuel your business growth with our website's specialized feature, offering swift and flexible financing solutions tailored to merchant cash flow, ensuring seamless access to capital.

Evaluate income based on Income Tax Return (ITR) data and perform trend analysis on income over the past 3-5 years.

Unlock valuable insights with Credit Bureau data, which employs asset quality classifications such as Standard, Special Mention Accounts (SMA), substandard, doubtful, and loss assets to evaluate risk across diverse loan types and asset classes, empowering lenders and investors to make well-informed choices.

Derive an Alternative Rating for any company, regardless of its size, scale, or industry, utilizing a rating model developed through regression analysis on over 40,000 rated companies.

Access a comprehensive list of court cases, including details such as the type of court, case dates, brief descriptions, summaries of court orders, and the convenience of easily searchable records.

Utilize advanced Machine Learning and NLP techniques to extract pertinent data from news, legal documents, and other sources. Incorporate this extracted information into the rating model, enhancing its effectiveness and providing valuable insights.

Establish ledger accounts for different loan products, allowing the creation of sub ledgers for added flexibility. Employ flexible accounting policies to address most requirements through the frontend interface.

Effortlessly configure ledgers for a variety of loan products, including the flexibility to establish sub-ledgers. Our flexible accounting policies empower you to manage most requirements directly from the front end.

Develop multiple configurable Masters enabling the definition of parameters, controls, and restrictions that can be modified at subsequent levels. Enable the swift creation of new loan products and instant scheme launches.

Empower your team to create custom schemes with ease by defining parameters and control restrictions that can be adjusted at subsequent levels. Launch new loan products and schemes in seconds with our user-friendly platform.

Introducing a highly comprehensive accounting solution meticulously crafted with carefully designed ledgers to effectively manage every intricate detail, catering to all business and regulatory requirements.

Streamline NPA Management with automatic loan classification into substandard, doubtful, or NPA categories, enhancing efficiency and risk assessment for your portfolio.

Facilitate efficient foreclosure management with automatic loan categorization into substandard, doubtful, or non-performing assets (NPA). Our verified accounting system ensures accuracy and reliability throughout the foreclosure, loan rescheduling, and loan restructuring processes.

Streamline the resolution process on our lending website with efficient foreclosure tools, enabling transparent communication and swift resolution of defaulted loans.

Effortlessly manage loan restructuring using our trusted accounting system, complemented by automated loan categorization into substandard, doubtful, or NPA categories for improved decision-making and streamlined operations.

Seamlessly process payments via NACH and e-NACH, simplifying transaction management.

Facilitate payments through traditional methods such as cheque or cash, providing flexibility to your customers.

Enable secure and efficient transactions using NEFT and RTGS, enhancing your payment options. Additionally, configure real-time bookkeeping for instant ledger updates.

Escrow Accounts Management: Safeguard your transactions on our lending website with meticulous oversight and secure handling of funds through our integrated escrow feature, ensuring trust and financial integrity.

Easily register mandates on the National Payments Corporation of India (NPCI) platform through our seamless system.

Introducing a highly comprehensive accounting solution meticulously crafted with carefully designed ledgers to effectively manage every intricate detail, catering to all business and regulatory requirements.

Configure alerts triggered by the registration of Post-Dated Cheques (PDCs) to streamline mandate presentation processes.

Efficiently monitor successful, failed, or partial payments across various payment nodes. Utilize filters based on dates, loan types, customers, and other criteria to streamline tracking and analysis.

Seamlessly manage your loan commitments on our website with automated reminder notifications, ensuring timely payments and fostering a smooth borrower experience.

Enable smooth reconciliation between the current account and multiple ledgers, ensuring a seamless process.

Early warning signal

By harnessing the power of 45 RBI prescribed indicators and our proprietary metrics, our robust Early Warning Signal system enables financial institutions to stay ahead of credit risks and vulnerabilities. Through timely alerts and actionable insights, institutions can make informed decisions, ensuring the health and stability of their lending portfolios.

Key components of credit assessment

Company Highlights

BL, PL, Cash Flow, Ratios

Open Charges

CARO, Auditors Report

Deep Dive : Revenue & Margin Drivers

Summary Financials

Red Flags + E.W.S.

AI based MCA wide Potential Related Parties

Group Structure,Related Parties

EPFO Data Analysis

Unstructured Data / News

Bureau Report + Unique Insights

Directors /Signatories + Changes

Scoring Based on Customizable parameters

Ready to Elevate Your Business?

Request a demo to explore their features and benefits.

Schedule a Demo